We Are Hiring – Senior Software Engineer (IoT)

Be a part of the digital transformation revolution! The Internet of Things (IoT) is

loading...

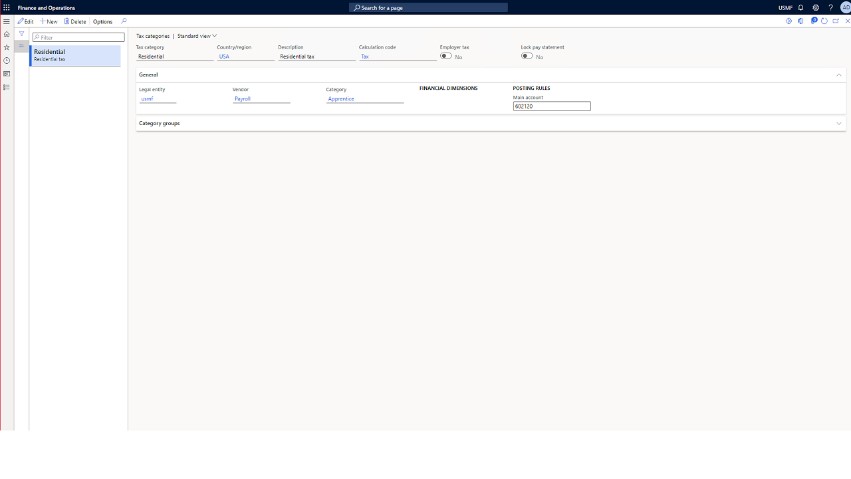

. . . . . .Customers have been looking for a flexible add-on for Microsoft Dynamics 365 F&O to process Payroll taxation. This is specifically a requirement for customers with legal entities across different regions to have a single, powerful payroll tax engine that they can use to handle diverse tax rules and regulations across these regions.

With KAISPE Flex Payroll, customers get a powerful and highly flexible tax engine that provides an intuitive rule and formula-based functionality to compute the tax contributions and deductions. The solution leverages the standard end to end payroll processing in Microsoft Dynamics 365 F&O.

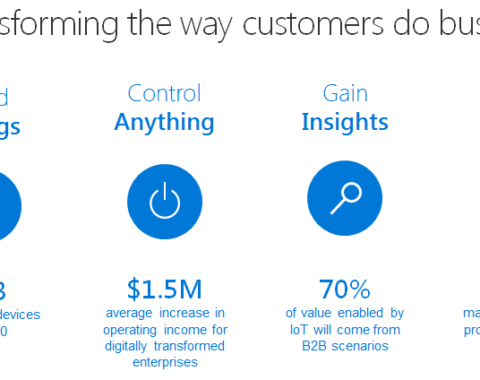

Customers across multiple regions and industries are adopting digital transformation

with KAISPE Solutions and Services.

Be a part of the digital transformation revolution! The Internet of Things (IoT) is

Due to inflated expectations and poor upfront planning, many IoT projects and proofs of

Introduction to Internet of Things (IoT) The Internet of Things is a Business Revolution

In this blog post, I will briefly talk about the plugable MXChip AZ3166 IoT

Today I will walk you through how to create Microsoft Azure IoT Hub and

Hi! Today in this blog post, I will demonstrate you how to get

Today we will be looking at how we can integrate Microsoft Azure IoT Central,

Imagine you joined a company that has been migrating to the cloud. This movement

Start steering value from your IoT investments using an IoT solution that does not

Today, I will walk you through why do we need to create createUiDefinition.json file

Hi, Today we will be evaluating the difference between of Azure Machine Learning Services

In today’s world water Irrigation / shortages are a major problem in many developed

Hi, As we all know water irrigation is the foundation of global agricultural productivity,

Today, we will be taking a look at the KAISPE IoT Portal specifically designed

Azure Machine Learning is a platform on which data scientists can develop machine learning

While working on one of our Machine Learning projects, I am using Microsoft Azure

Recently we had a chance to work on developing a custom connector in Microsoft

Earlier this year, Microsoft acquired Softomotive, a low-code robotic process automation company focused on

As you might aware that in Microsoft Dynamics 365 CE, you can maintain a

Today we are going to talk about Microsoft PowerApps Monitor. The idea behind the

The end goal of your IoT journey is to transform not just physically, but

Microsoft recently announced that they will invest $5 billion in the Internet of Things

The World’s Largest IoT Conference Series; the IoT Tech Expo event will bring together key industries

It was really exciting to participate in the Global IoT Expo in Olympia, London.

Industrial manufacturing is undergoing a digital transformation. Factories are no longer disconnected from their

The Internet of Things is poised to connect some 25 billion users by 2020,

A quick snapshot of how the businesses will be transformed in next couple of

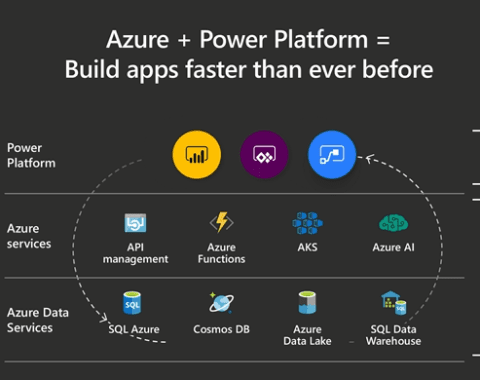

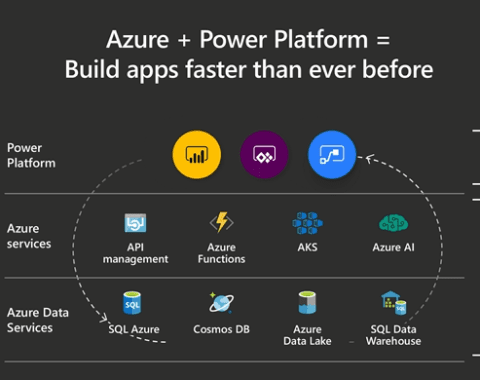

Microsoft has been hard at work innovating for our customers and partners by providing

Sr. Product/Service Delivery Manager Lead the strategy, vision, and prioritization of product features that

KAISPE is an startup firm with strong focus on Microsoft Azure platform based IoT

Microsoft has released Azure IoT Certification program. This course provides an introduction to Internet

While I was working on KAISPE Agricultural Farming Application, one of the requirements was

Today, I will show you the basic idea about how to Add or Remove

Today, I will show you the basic idea about how to save the data

Today we will walk-through a simple experiment in Azure Machine Learning Studio that will

With a variety of industrial compressors and the high cost associated with their acquisition

As KAISPE team is working on an IoT solution accelerator for Air Compressor remote

Azure IoT Plug & Play (PnP) IoT Plug & Play (PnP) makes device integration

As we all know Microsoft new release about Microsoft Azure IoT Central Updates where

Microsoft has recently announced several major updates to Azure IoT Central that will surely

With increasing demand of having Predictive Maintenance for Connected Assets, KAISPE has introduced predictive

A Must Read eBook to understand the Factory of Future concept…Please download from this

This talk helps you understand how to leverage the Azure Machine Learning SDK to

In a recent effort to add predictive maintenance functionality in one of our products,

Today, I will be giving you an overview about Team Data Science Process (TDSP),

In today’s world, production efficiency can be improved by maximizing the time that the

When you think about your experiences as a customer—from buying groceries to buying a

We are pleased to inform our partners and customers that Microsoft Azure IoT Central

NEW YORK, December 21, 2019 – KAISPE is pleased to announce that one of

A Chatbot is a software program that talks audibly or textually, such programs predict

Language Understanding Intelligent Service (LUIS) is NLP (Natural Language Processing) Service. Microsoft Azure also

In an study with different schools, teachers shared how high attrition rates affect classroom

In a recent survey of business executives, 45% report IoT has helped boost profits

Employee Churn prediction has always been a challenge for organizations. Powered by Microsoft Azure

As I was working on Student Churn Prediction model using Azure Machine Learning (ML

Organizations are committed to optimizing the use of resources to deliver the required business

Automation has always been a key to businesses to achieve higher productivity and lower

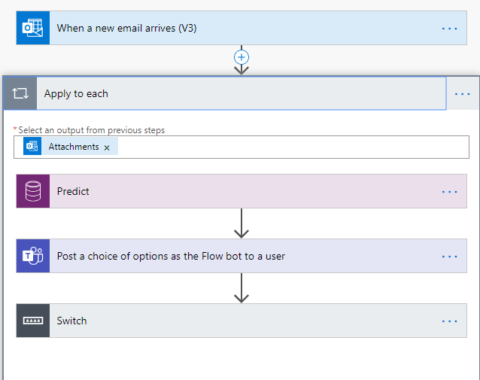

Recently I was working on a scenario where I have to automatically generate a

As we all know, the healthcare industry is a complex field, with many participants

Dealing with Parent Child data in Power Portal and Power Automate scenario’s can be

In an introductory, RPA software robots can automate data entry, error reconciliation, and some

At KAISPE, we have been developing some really useful productivity solutions to meet enterprise

Brian Dang, a teacher in Southern California, shares his story of using PowerApps to

Microsoft PowerApps provides a robust set of capabilities to build your business applications. However,

As the world continues to adapt to the reality of remote working, customizing digital

Today, We will show you how to create OData web services for Microsoft Dynamics

Hi, With the Modern App Designer, Makers can seamlessly configure their model-driven applications for

Hi all, Now, we can Bring our own AI builder model into Power Platform

Now you can bring the efficiency and simplicity of AI Builder to Microsoft Teams

In this blog I will teach you how you can use Power Virtual Agents

This article will help you to create a test case using the Test studio

Hi, we had a scenario where one of our customers is using On-premises version

As part of app publishing process on Microsoft AppSource, we were trying to add

Recently, Microsoft announced PowerApps ISV Studio public preview which is I think a turning

Some people say that Microsoft Forms is one of the most underrated Office 365

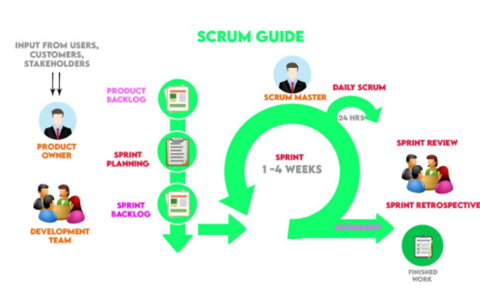

This article identifies and short briefing of the scrum, key benefits of Scrum, and

Microsoft Power Pages are the extension of Power Apps Portals that runs on Microsoft

Testing applications an integral part of the development process. But, how can the team

You can Quickly create new sites directly from the Microsoft Power Pages home page

If you’re looking for a solution to manage day-to-day financial transactions and accounting for

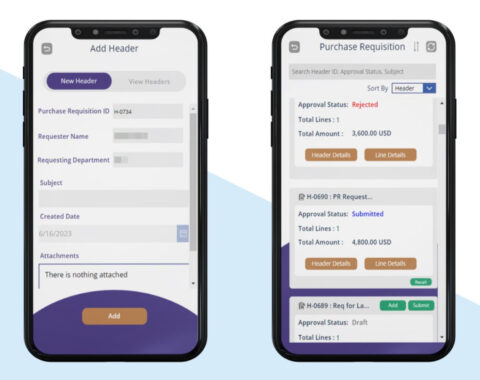

Today, we will walk through developing the functionality of Purchase Requisition functionality in Microsoft

In this blog post, I will write step-by-step on how to create a new

Introduction Android provides several ways to store persistent data. Each of these has its

Modern authentication mechanisms for web application Authentication: Process of verifying the credentials of a

Background: Connection reference enable you to interactively specify the connection details and configuration settings

As a part of deployment process in Microsoft Azure Devops ,when we trying to

Continuous Integration/Continuous Delivery (CI/CD) has always been, and still is, the responsibility of DevOps professionals. But now that GitHub has CI/CD capabilities thanks to GitHub Actions, it’s simpler than ever to integrate CI/CD into your process model directly from your GitHub repo. Step 1: Create or choose a repository It might sound

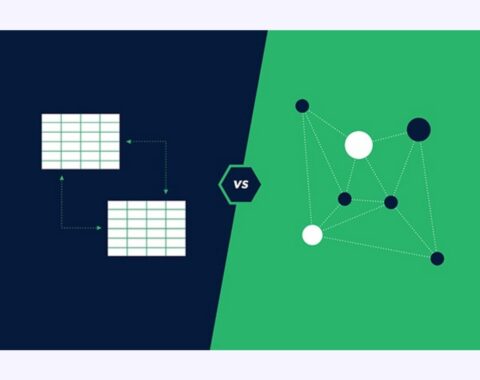

The two primary forms of databases are SQL (Relational) and NoSQL (Non-Relational). Making the

Code reusability is the major factor to develop an efficient software. Reusing code can

Figma can absolutely be used for UX design and many designers are already using

In an introductory, RPA can automate time-consuming and repetitive tasks by using Microsoft Power

This functionality is already present in the Model-Driven App, but what if we use

Withholding is an act of deduction or collection of tax at source, generally an

Consider the following scenario: You attempt to use your website’s GET() endpoint to retrieve

Introduction Are you torn between using client-side rendering and server-side rendering for your web

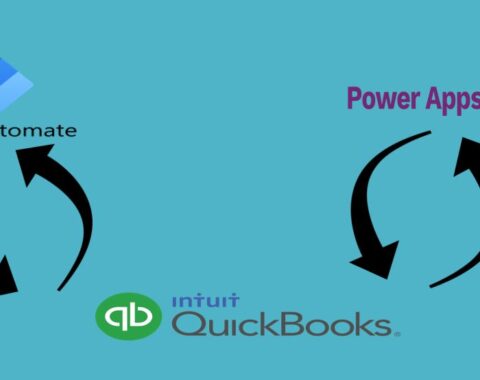

QuickBooks’ custom connector using Microsoft Power Platform allows us to integrate QuickBooks with other

Speech Therapy Apps – In today’s digital era, as hard as you try, it

Power Automate and Power Apps presently support more than 900 connectors, which let us

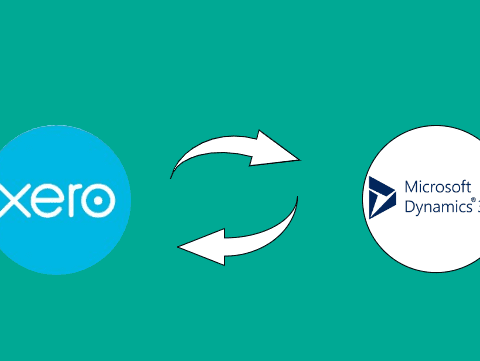

Integrating third-party solutions into your business processes can greatly enhance your overall efficiency and

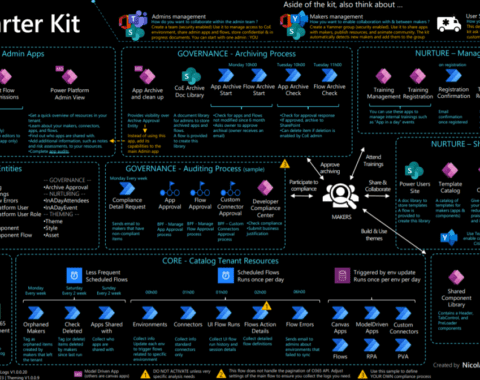

Overview A Center of Excellent (CoE) can be described as a competency or capability

Using OpenAI ChatGPT Custom Connector with KAISPE AI based HR Recruitment Automation App When the HR

Have you ever tried scheduling a report in Business Central only to find out

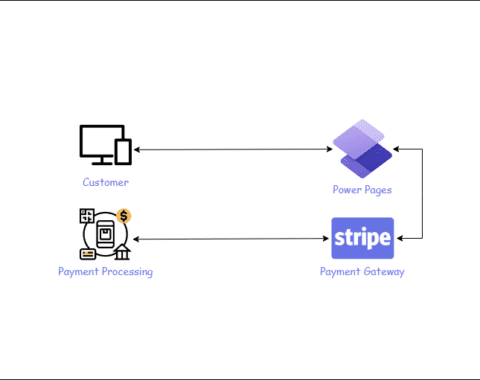

Stripe Payment method integration on Power Pages Power Pages is a powerful tool for

Figma is a popular cloud-based design tool that allows designers to create high-quality interfaces

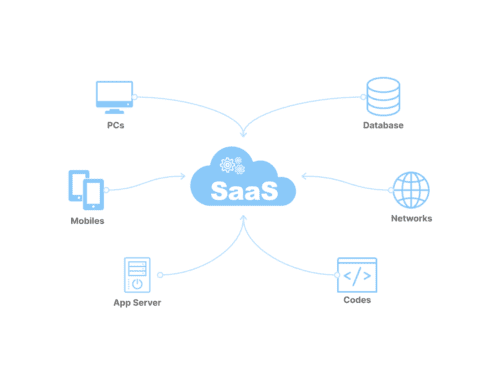

Software as a Service (SaaS) A Software-as-a-Service (SaaS) application is a software delivery model

When building a React application, you might encounter a situation where you need to

The future of chatbots and natural language processing is here and businesses of all

Welcome to our comprehensive guide on connecting OpenAI with Power Apps Canvas applications using

Business Scenario: In our HR recruitment application, we encounter a challenge where candidates submit

Welcome to our comprehensive guide on converting Power Apps canvas application to Android APK

Challenge: As we progress with the development of Applications in PowerApps, we realized that

Overview In today’s interconnected world, language barriers can hinder effective communication and limit the

In today’s fast-paced business landscape, efficient route optimization plays a pivotal role in ensuring

In the fast-paced world of retail and commerce, staying ahead of the competition requires

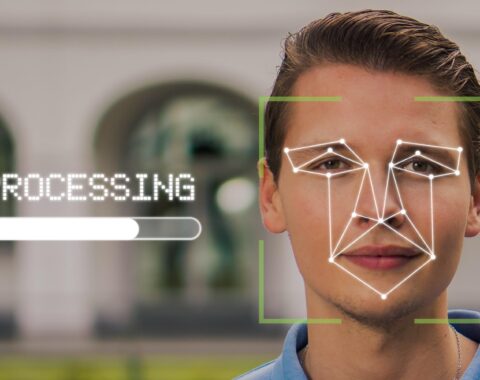

Integrate Lobe AI with Power Apps for Facial Identification Facial recognition and identification are

This blog is dedicated to leveraging the power of Power BI to create insightful

Dealing with purchase orders is one of the fundamental elements in most businesses. And

In today’s tech-driven world, AI and machine learning are reshaping industries. This blog explores

NetSuite is a powerful cloud-based ERP system that provides a wide range of features

Today, whatever system you pick, it is about AI or ready to incorporate AI.

The goal of OpenAI, a pioneer in AI research, is to make sure that

In the ever-evolving landscape of application development, efficiency and speed are paramount. Microsoft, a

Microsoft Explore Marketplace products and solutions with AI: Preview now available In the ever-evolving

Field workers face numerous challenges while conducting inspections and assessments in today’s fast-paced world.

Hiring can be a real challenge. Going through a huge pile of endless resumes

NetSuite’s Electronic Bank Payments emerge as a crucial tool for businesses, offering a secure

In the dynamic realm of application development, where rapidity and efficiency are crucial, Microsoft,

Our routines are no less than robotic lifestyles. Job, family, and even social life

Presenting Copilot in PowerApps, your dynamic assistant that changes application improvement into a consistent

Geofencing is a powerful feature that allows you to define virtual boundaries around a

Technology in today’s world is quite surprising in the wonder it can do for

Every business has a wide range of purchasing needs, ranging from raw materials and

In the dynamic landscape of modern business operations, companies often find themselves managing multiple

In the vast landscape of enterprise resource planning (ERP) solutions, Microsoft Dynamics 365 Business

Have an expert get back to you.

Available Monday to Friday

8 AM to 5 PM Eastern Time

Available Monday to Friday

8 AM to 5 PM Eastern Time

Call: +1 3157914472

It’s our mission to help clients win. We’d love to talk to you about the right business solutions to help you achieve your goals.